Episode Title: Facts HMDA reporting: A thorough publication to own loan providers

The house Financial Disclosure Work, otherwise HMDA, are a national legislation that needs mortgage lenders to store analysis and you may records regarding their financing techniques. These records must also getting published to the newest regulating bodies so that credit associations are in this compliance to be able away from HMDA, that’s to keep track of fair lending which will make visibility and you can cover borrowers.

The new guidelines from HMDA shall be difficult to track, however, all mortgage loan lenders need to find out throughout the HMDA revealing. Otherwise, they could deal with strong punishment as well as dump new customers possibilities. This complete publication will help you to discover all you need regarding the HMDA guidelines and ways to improve your HMDA conformity management.

Reputation of HMDA

The home Financial Revelation Act are passed by Congress in the 1975. It actually was followed by Government Put aside Board’s Control C. Inside , the fresh new rule-composing power from Control C are relocated to the user Monetary Safety Bureau, otherwise CFPB. The brand new control stated that the fresh collected societal financing study you’ll be employed to determine whether financial institutions is actually offering the fresh construction needs of the communities and you will help social officials inside the posting societal-market investments to draw individual capital. HMDA can also help select you can easily discriminatory credit strategies that really must be handled.

HMDA revealing agencies

Loan providers eg banking institutions, coupons contacts, mortgage lending establishments, and you will borrowing unions need certainly to report below HMDA. One place that have loan origination from 2 hundred or higher discover-prevent personal lines of credit need gather, number, and you may fill in the profile to HMDA. But not, when your loan or credit line is not a shut-stop real estate loan or an unbarred-avoid line of credit, it will not have to be claimed. At exactly the same time, banks, borrowing from the bank unions, and you will preserving connectivity with possessions away from $54 million otherwise less are excused of get together and you may revealing HMDA data to possess 2013.

HMDA revealing conditions

Home purchase loans, home improvement financing, and you will refinancing finance are sort of fund one to affect HMDA revealing requirements. The mortgage also needs to be an open-avoid credit line otherwise a shut mortgage loan to qualify having HMDA revealing.

The loan App Register (LAR) analysis sphere necessary for a keen HMDA declaration were applicant advice, as well as demographic data such battle, gender, ethnicity, and you will earnings, along with loan pointers including the app studies and you will number of the borrowed funds, along with home elevators security therefore the current standing of your own financing.

FI’s that have a blended full out of sixty,000 programs and shielded finance (leaving out purchased money) within the preceding twelve months must report HMDA research into an effective every quarter base. FI’s has actually 60 months following the avoid of one’s calendar one-fourth to submit their HMDA Application for the loan Register (LAR), with the exception of the brand new last quarter, that is susceptible to a distribution due date for the seasons-to-date file to your March https://clickcashadvance.com/loans/legitimate-online-loans/ initially.

Study range and submission

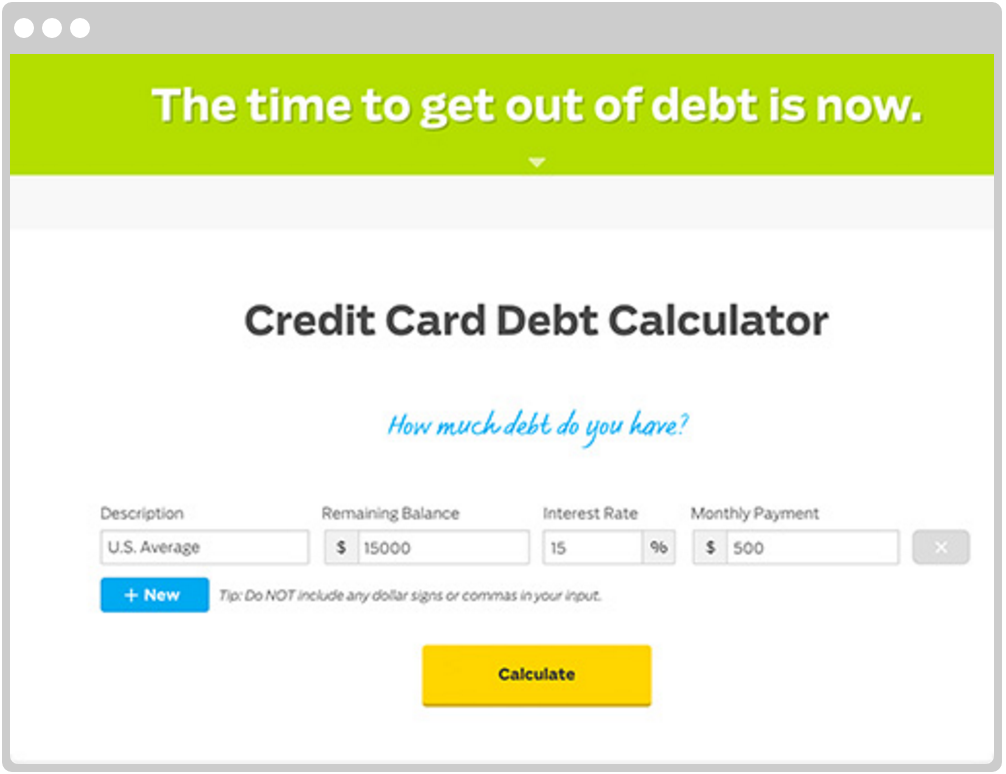

To get the mandatory research to own HMDA, you should stick to the LAR submitting processes and you may carefully complete most of the required industries for financing. You should make sure to haven’t remaining one industries blank otherwise has accidentally withheld any recommendations. Playing with HMDA app instance HMDA Wiz allows you to convey more successful studies collection and submitting.

Study disclosure and you may public access

The content amassed less than HMDA is the most complete source of public records with the United states home loan business readily available. While this you’ll increase concerns about privacy and data anonymization, the reason one to HMDA are introduced were to carry out transparency and inform you as to what types of money are place, who’s getting them, of course, if loan providers is permitting the communities. It’s important you to definitely analysis feel clear both for users and you may authorities in the industry.

HMDA low-conformity charges

In the event that a lending institution isnt certified which have HMDA revealing, there are administration methods that can be removed that will undoubtedly harm loan providers. For those who have mistakes, you are needed to resubmit research, and certainly will exposure regulatory violations and you may civil economic charges. Almost every other administration tips you are going to include audits of your own business and you will judge effects in case it is discovered that you are violating anti-discriminatory statutes. Thus, the crucial thing you take steps so you can mitigate threats and you may make sure compliance.

Recommendations getting HMDA compliance

To make sure that you are fulfilling the newest HMDA compliance requirements and does not come across any possible things later, you should know best practices for your HMDA revealing. Teach your entire employees and you will employees which help educate them to the significance of HMDA compliance. It’s also wise to implement robust study management process with the intention that nothing slips according to the radar. Regular audits and you may conformity checks with HMDA software is even a powerful way to find facts prior to it become troubles.

End

The HMDA try enacted to produce openness and you may reasonable lending means in home mortgage loans. It’s become more importantly typically to stay in compliance so your investigation range and you may revealing try seamless. You will want to stand up-to-date with the fresh HMDA statutes and you will amendments, you commonly ever before blindsided when it is time and energy to report. By generating reasonable financing openness regarding mortgage business, you could help to improve their institution’s reputation, your neighborhood and stay a chief in the conformity government.

For more information on HMDA, sign up for the publication and possess tips, campaigns, and standing into everything you need to discover HMDA.